The global dating app industry has experienced unprecedented growth, evolving from a niche digital service to a mainstream social phenomenon that shapes how millions of people connect and form relationships worldwide. As we navigate through 2025, the landscape continues to transform with technological innovations, cultural adaptations, and shifting user behaviors across different regions.

The dating app market has demonstrated remarkable resilience and growth, with the global market size reaching $13.1 billion in 2025 and projected to expand to $21.9 billion by 2030. This represents a compound annual growth rate (CAGR) of 8.9%, reflecting the increasing acceptance and integration of digital dating platforms into modern social life.

Market Leadership and User Demographics

The competitive landscape is dominated by a few key players, with Tinder maintaining its position as the global leader with 75 million monthly active users, followed by Bumble with 50 million users. However, regional preferences and cultural factors significantly influence market dynamics, creating opportunities for both established and emerging platforms to capture specific demographic segments.

In the United States, the market shows a highly competitive environment with Tinder holding 25% market share, closely followed by Bumble at 24%, and Hinge capturing 18% of the market. This near-parity between the top contenders reflects the mature nature of the American dating app ecosystem and users’ willingness to experiment with multiple platforms.

Country-by-Country Analysis

Core Markets Analysis

| Country/Region | Top Dating Apps | Monthly Active Users | Notable Features | Demographics | Cultural Insights |

|---|---|---|---|---|---|

| United States | Tinder (25%), Bumble (24%), Hinge (18%) | Tinder: 75M global, Bumble: 50M global | Swipe-based matching, AI-powered recommendations, Super Likes | Gen Z (49%), Millennials (35%), 75% male on Tinder | Casual dating normalized, Hookup culture prevalent, Low parental involvement |

| Brazil | Tinder, Bumble, Badoo | Tinder: 10M users, 1M daily matches | Casual dating culture, No stigma around online dating | Gen Z/Millennials (70%), 20s-30s focus, Gender balanced | PDA accepted, Fast-paced relationships, Carnival culture influence |

| Germany | Tinder, Bumble, Lovoo, Badoo | Tinder: 7M users, Bumble: 2M users | Personality-based matching, Location filters, Video profiles | Under 35 (65%), Urban professionals, Gender balanced | Direct communication, Efficiency-focused, Work-life balance important |

| France | Badoo, Hinge, Tinder | Badoo: 8.8M users (13% of population) | Geolocation matching, Video chat, Photo verification | Under 40 (70%), Urban focus, Professional class | Romance emphasized, Casual group dates, Wine/cafe culture |

| United Kingdom | Hinge, Tinder, Bumble | Tinder: 5M users, Hinge: 1.2M users | Relationship-focused prompts, Voice messages, Video calls | Millennials (55%), Urban professionals, Gender balanced | Pub culture, Indirect communication, Slow commitment approach |

| Japan | Pairs, Tinder, Happn | Pairs: 1.5M users, Tinder: 800K users | Compatibility questionnaires, Marriage-focused, Mother-in-law questions | Marriage-focused (80%), 25-40 age range, Professional class | Group dating common, Indirect communication, Marriage-focused |

| India | Tinder, Bumble, Hinge, TrulyMadly | Tinder: 20M users, Bumble: 5M users | Verified profiles, Regional language support, Cultural filters | Urban millennials (60%), English-speaking, Professional class | Family involvement high, Arranged marriage tradition, Changing attitudes |

| South Korea | Amanda, Tinder, Pairs | Amanda: 5M users, Tinder: 2M users | Scoring system (3.0+ rating required), Appearance-focused | Young professionals (70%), Appearance-conscious, Urban focus | Appearance important, Competitive dating, Low birth rates concern |

| Nigeria | Tinder (32%), Badoo (12%), Bumble (8%) | Tinder: 4M users, Badoo: 2M users | Location-based matching, Video profiles, Gift system | Urban youth (65%), Tech-savvy, Professional class | Extended family involvement, Religious considerations, Urban vs rural divide |

| South Africa | Tinder, Badoo, Bumble | Tinder: 10M users, Badoo: 3M users | Swipe-based matching, Local events, Community features | Urban millennials (55%), English-speaking, Professional class | Multi-cultural dating, English preference, Urban lifestyle focus |

| Mexico | Tinder, Bumble, Happn | Tinder: 8M users, Bumble: 2M users | Casual dating focus, Festival culture integration | Gen Z/Millennials (68%), Urban focus, Casual dating | Machismo culture, Family involvement, Festival/celebration integration |

| Canada | Hinge, Tinder, Bumble | Hinge: 3M users, Tinder: 4M users | Relationship-focused, Personality prompts, Video dating | Professionals (60%), Relationship-focused, Urban/suburban | Polite culture, Relationship-focused, Outdoor activity dates |

| Indonesia | Tinder, Badoo, OkCupid, IndonesianCupid | Tinder: 6M users, Badoo: 4M users | Cultural compatibility, Religious filters, Photo verification | Urban millennials (50%), Multi-cultural, Religious diversity | Religious diversity, Family approval important, Multi-cultural acceptance |

| UAE | Badoo, Tinder, Bumble, Muslima | Badoo: 2M users, Tinder: 1.5M users | Halal dating features, Chaperone options, Cultural sensitivity | Expats (40%), Local professionals (60%), Multi-cultural | Conservative values, Expat community, Halal dating important |

| Australia | Bumble, Tinder, Hinge | Bumble: 1.7M users, Tinder: 6M users | Women-first messaging, Friend-finding mode, Professional networking | Urban professionals (65%), Gender balanced, Educated | Progressive values, Outdoor culture, Gender equality emphasis |

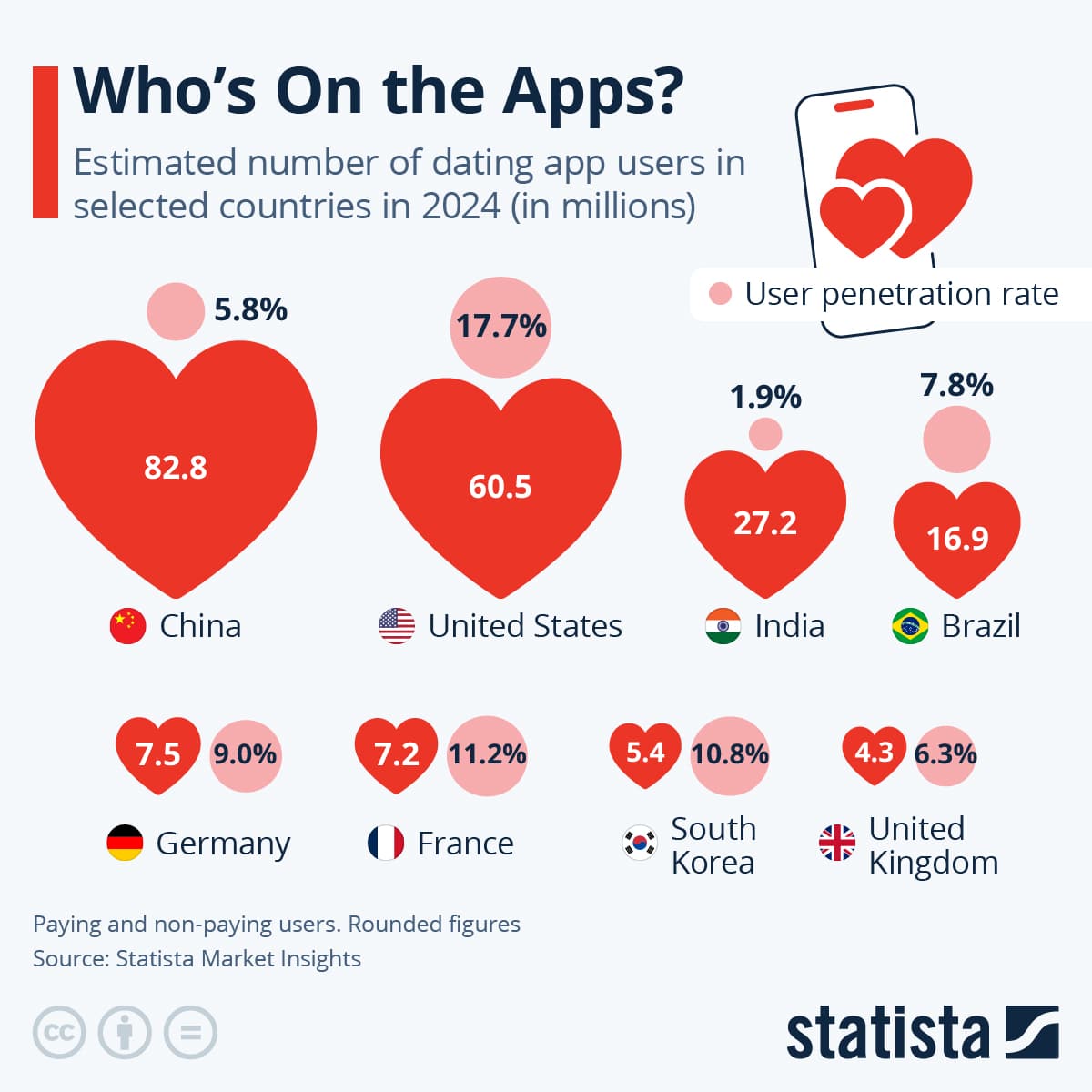

The user base statistics reveal significant variations in market penetration across different countries. While China leads in absolute numbers with 82.8 million users, the United States shows the highest penetration rate at 17.7% of the population, followed by France at 11.2% and South Korea at 10.8%.

Regional Cultural Patterns and Preferences

Western Liberal Markets

Countries like the United States, Canada, Australia, and the UK represent the most mature dating app markets, characterized by high acceptance rates (70-80%) and individualistic approaches to dating. These markets favor apps like Tinder, Bumble, and Hinge that support both casual and serious relationship seeking.

East Asian Markets

Japan, South Korea, China, and Singapore demonstrate unique characteristics with marriage-oriented preferences and family involvement in dating decisions. Apps like Pairs in Japan and Amanda in South Korea have gained traction by addressing specific cultural needs, including compatibility questionnaires and appearance-based matching systems.

European Markets

European countries show preference for romance-focused platforms with apps like Badoo performing strongly in France and other Continental European markets. The dating culture emphasizes slower relationship development and traditional courtship elements.

Emerging Markets

Countries in Africa, Latin America, and parts of Asia are experiencing rapid growth in dating app adoption. Tinder maintains strong positions in these markets, while regional players like SweetMeet in Kenya and various cultural-specific platforms are gaining momentum.

New and Emerging Dating Apps (2024-2025)

The dating app landscape continues to evolve with innovative platforms launching to address specific market needs and user preferences. Several noteworthy apps have emerged in 2024-2025, each targeting distinct demographics and offering unique value propositions.

Location-Based Innovation

Left Field launched in 2025 with a “Pokémon Go” style approach to dating, sending push notifications when users cross paths with potential matches. Starting with a pilot program in New York City, the app is expanding to college campuses to capture the Gen Z demographic.

AI-Powered Platforms

Rizz AI and Hily AI represent the growing trend of artificial intelligence integration in dating apps. These platforms use AI to write conversation starters and learn user preferences for more accurate matchmaking, responding to the 68% of users who want AI assistance in profile optimization.

Personality-Focused Apps

Boo has gained traction by emphasizing personality compatibility over appearance-based matching, addressing the 86% of users who value personality over looks. The app uses comprehensive personality assessments to create meaningful connections.

Community-Specific Platforms

Several niche apps have emerged to serve specific communities:

- Muzz (rebranded from Muzmatch) focuses on Muslim dating with halal features and chaperone options

- Arike targets Malayalam speakers globally with cultural community features

- Kippo serves the gaming community with preferences based on gaming habits and interests

Anti-Swipe Fatigue Solutions

Thursday operates only on Thursdays, addressing user fatigue with endless swiping by limiting availability to one day per week. This approach appeals to busy professionals seeking quality over quantity in their dating experience.

Key Trends Shaping Dating Apps in 2025

The dating app industry is experiencing several transformative trends that are reshaping user experiences and platform development strategies.

AI-Powered Matchmaking

Artificial intelligence has become the cornerstone of modern dating apps, with 68% of users expressing interest in AI-assisted photo selection and matching. Leading platforms like Hily AI, Rizz AI, and Tinder AI are leveraging machine learning algorithms to understand user preferences and improve match quality.

Video-First Dating

The shift toward video-first interactions reflects changing user preferences, with 35% of users preferring video introductions over static photos. Apps like Snack, Hinge, and Bumble are incorporating TikTok-style video profiles to create more authentic connections.

Personality-Based Matching

With 86% of users valuing personality over physical appearance, apps are investing heavily in compatibility assessments and personality-driven algorithms. Platforms like Boo, eHarmony, and Hinge are leading this trend with comprehensive personality tests and meaningful conversation prompts.

Cultural Sensitivity and Inclusivity

The growing demand for cultural sensitivity features has led to the development of apps with language support, religious filters, and cultural considerations. 67% of users want cultural filters, driving the success of platforms like Muzz, Arike, and TrulyMadly.

Privacy and Security Focus

With 78% of users prioritizing privacy, dating apps are implementing enhanced security measures, identity verification, and data protection features. This trend reflects growing awareness of digital privacy concerns and the need for safer online dating experiences.

Cultural Insights and Dating Behaviors

Dating behaviors and app preferences are heavily influenced by cultural factors, creating distinct patterns across different regions and societies.

Online Dating Acceptance Rates

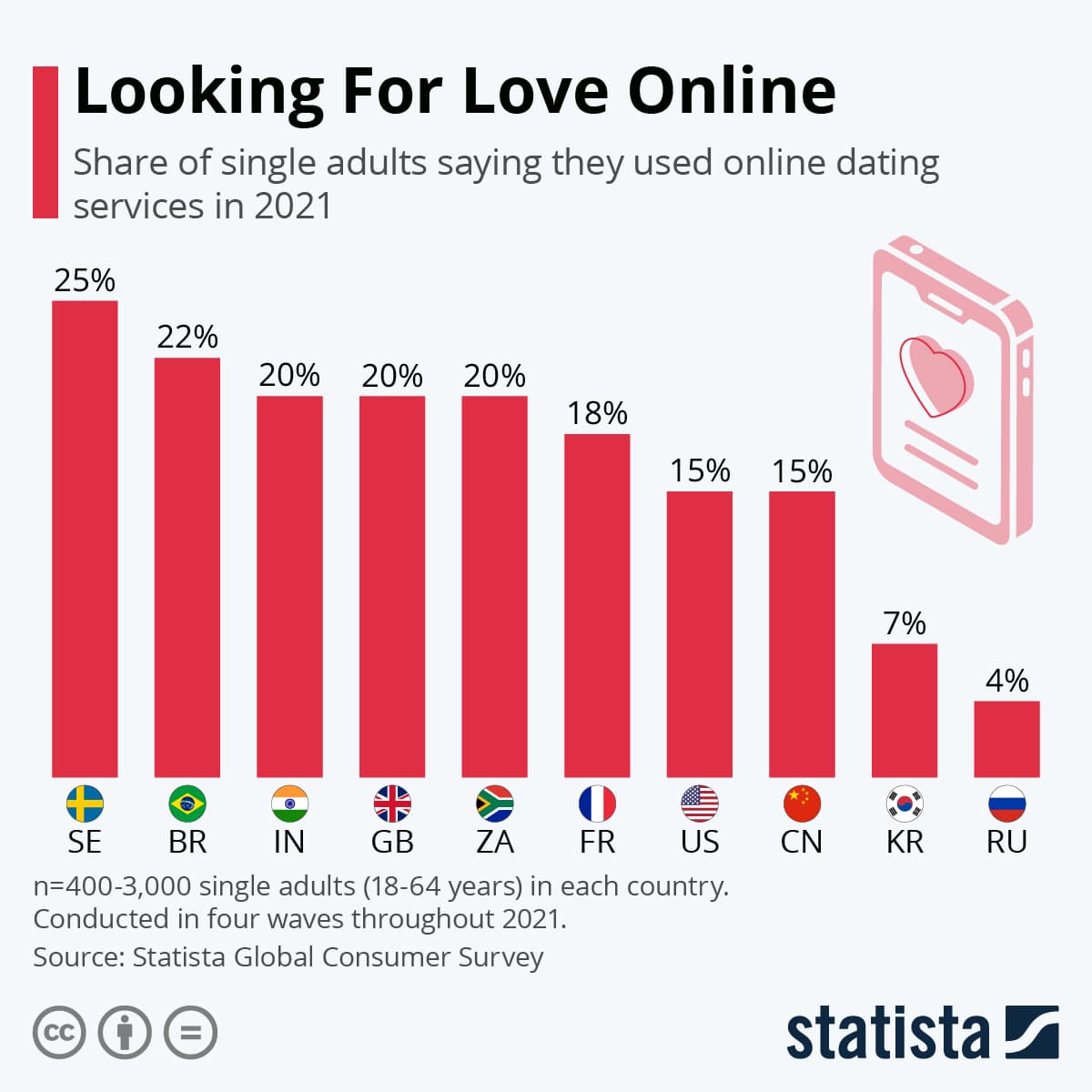

The acceptance of online dating varies significantly across cultures:

- Nordic/Scandinavian countries: 75-85% (fully normalized)

- Western Liberal markets: 70-80% (fully normalized)

- Latin American countries: 60-75% (high acceptance)

- Western Conservative markets: 60-70% (widely accepted)

- East Asian markets: 40-60% (growing acceptance)

- South Asian markets: 30-50% (moderate acceptance)

- African markets: 25-45% (emerging acceptance)

- Middle Eastern markets: 20-40% (cautious acceptance)

Cultural Dating Patterns

Different cultural clusters exhibit distinct approaches to relationships:

Western Liberal cultures (US, Canada, Australia, UK) emphasize individual choice and casual-to-serious relationship progression with low parental involvement.

East Asian cultures (Japan, South Korea, China, Singapore) focus on marriage-oriented relationships with significant family involvement and group dating customs.

Latin American cultures (Brazil, Mexico, Argentina) embrace passionate, fast-paced relationships with family awareness and celebration integration.

Middle Eastern cultures (UAE, Saudi Arabia, Qatar) prioritize marriage-focused, religiously compliant relationships with conservative values and expat community influence.

Market Statistics and Revenue Trends

The dating app industry continues to demonstrate strong financial performance and growth potential across multiple metrics.

Revenue Leadership

Match Group remains the dominant force in the industry, generating $3.5 billion in revenue, while Tinder leads individual app performance with $171 million in monthly revenue. The Asia-Pacific region shows the fastest growth rate at 8.5% CAGR, indicating significant expansion potential in emerging markets.

User Engagement Patterns

Active users spend an average of 80 minutes daily on dating apps, with retention rates improving to 3.3% in 2024. However, less than 5% of monthly subscribers remain active after 12 months, highlighting the challenge of long-term user engagement.

Global User Base

The global dating app user base has reached over 500 million active users in 2025, with projections indicating continued growth driven by smartphone penetration and changing social norms around digital dating.

Conclusion

The global dating app landscape in 2025 represents a mature yet rapidly evolving industry characterized by technological innovation, cultural adaptation, and diverse user preferences. While established players like Tinder and Bumble maintain market leadership, the success of regional and niche platforms demonstrates the importance of cultural sensitivity and targeted user experiences.

The emergence of AI-powered matchmaking, video-first interactions, and personality-based matching reflects users’ desire for more meaningful connections and efficient dating experiences. As the industry continues to grow toward an estimated $21.9 billion market by 2030, platforms that successfully balance global scalability with local cultural adaptation will likely capture the most significant market opportunities.

The data reveals that successful dating apps must navigate complex cultural landscapes, address privacy concerns, and continuously innovate to meet evolving user expectations. Whether targeting broad demographics or specific communities, the most successful platforms will be those that understand and respect the cultural nuances of their target markets while leveraging technology to create authentic, meaningful connections.